Real Info About How To Avoid Jumbo Mortgage

In 2010, the national limit is $417,000, but some.

How to avoid jumbo mortgage. Obtaining a second mortgage loan or paying the difference in cash are your two options to avoid using a jumbo loan. Make a bigger down payment Full income documentation is required.

To qualify, a borrower should expect the following: How can i avoid a jumbo loan? There are two possible ways to avoid a jumbo loan (aside from buying a less expensive home).

Thus, piggybacking a second conforming loan on a first conforming loan is the way to avoid jumbo loans. How to avoid a jumbo mortgage (and its jumbo rate) 1. Get a conforming mortgage and get a second mortgage along with it.

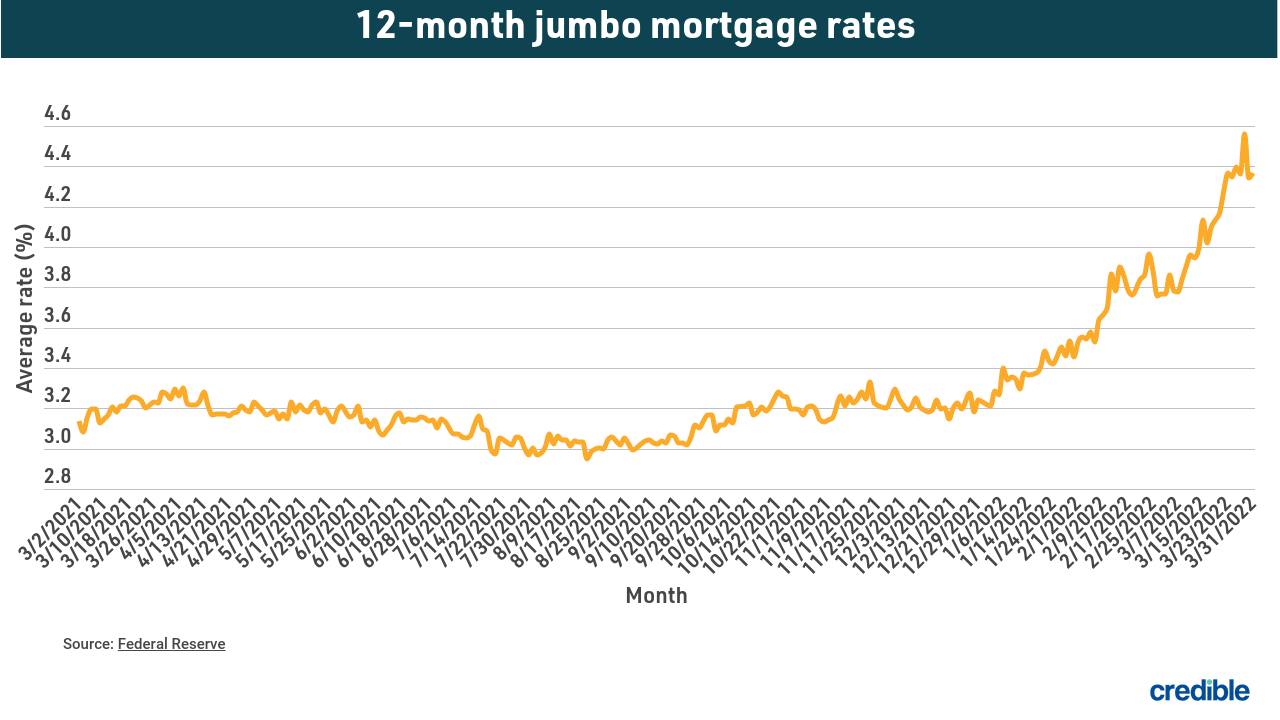

Put down a large enough down payment so that they. If the second mortgage rate is higher than those shown, you do better taking the jumbo first. Only if the loan you can get by two mortgages doesn't suffice for your home,.

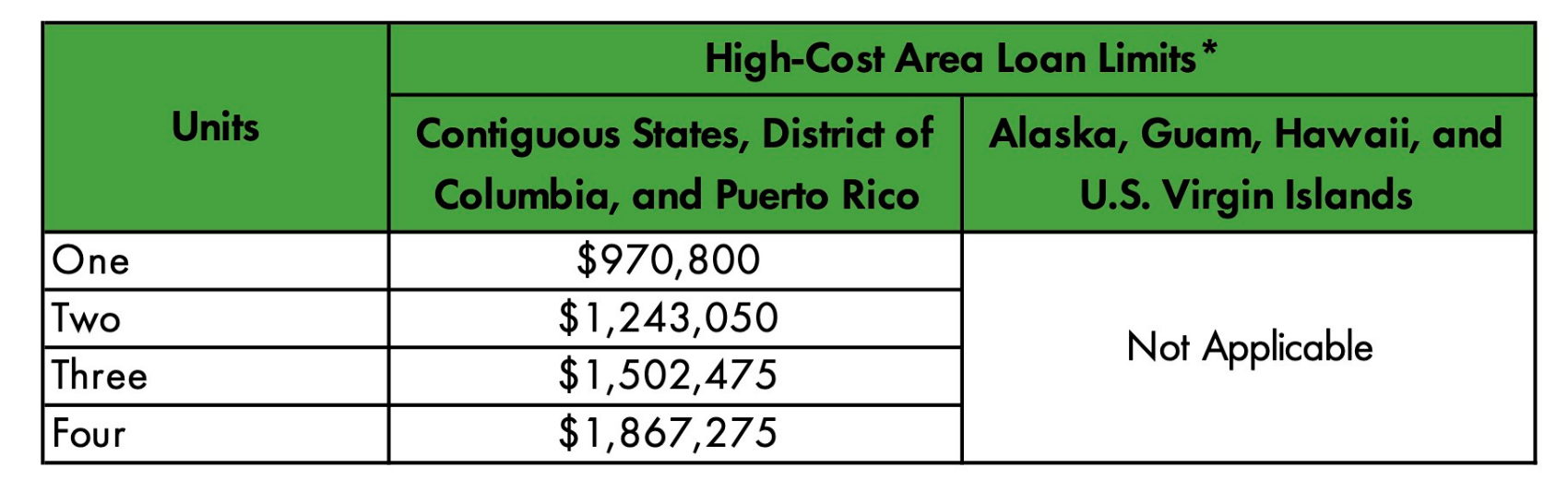

Assuming you can find one, how do you avoid paying a jumbo’s higher interest rate? You should have a least 50% of the. Look up the conforming loan limit for the area where you home is located.

If you can get a second mortgage for less, you come out ahead using the second mortgage. One of the most common forms of real estate fraud is a form of phishing which requires buyers or sellers to send money to illegitimate accounts. How can i get around jumbo loan requirements.

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)